In fulfillment of the directive of His Excellency, the Governor of Cross River State, Apostle Senator Prince Bassey Edet Otu, to sanitize the forestry sector, eliminate illegal revenue collection, and streamline the state’s revenue system, the Cross River State Forestry Commission hereby announces the automation of evacuation passes and the consolidation of all recognized revenue sources.

This reform is designed to enhance accountability, ensure transparency, and boost internally generated revenue (IGR) in line with best practices. By automating evacuation passes, the Commission seeks to curb fraudulent practices, strengthen monitoring, and promote sustainable forest management across the state.

The following are the approved and recognized revenue sources, as authorized by the Cross River State Internal Revenue Service (CRIRS):

-

Fines and Fees

-

Hammering Fees

-

Industrial Development Levy on Timber

-

Joint Tax Board (JTB)

-

Road Infrastructure Levy

-

Timber Market

-

Chain Saw

-

Saw Mill

-

Timber Shades

-

Non-Timber Forest Products (NTFPs)

-

Levies from Quarries Operating in Forest Reserves

-

Levies from Farms Operating in Forest Reserves

The general public, contractors, and stakeholders are strongly advised to seek clarification directly from the office of the Chairman/CEO of the Forestry Commission. Any individual, group, or company found engaging in unauthorized revenue collection outside the listed items will face serious legal and administrative consequences.

The Commission assures all stakeholders of its unwavering commitment to restoring integrity and efficiency within the forestry sector.

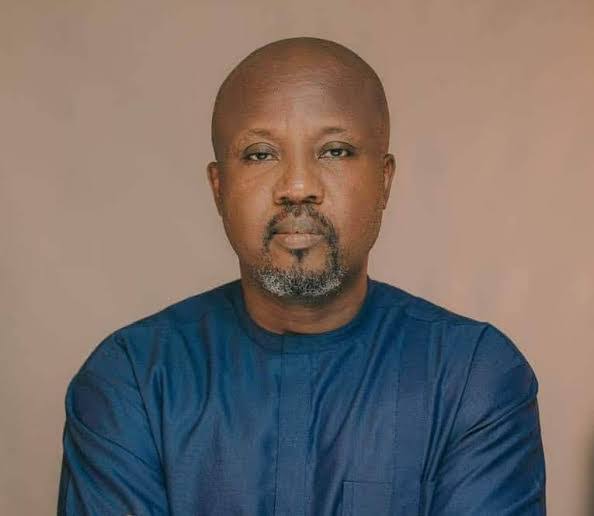

Signed:

Ntufam Rt. Hon. Deacon George O’ben-Etchi, PhD, FCIA

Chairman/CEO

Cross River State Forestry Commission